In a recent Journal News article, the reporter referenced the 2020 Operational Budget Work Session Meeting on January 21, 2020 where comments were made about a possible Police and Fire levy in the near future. In this article I discuss and answer the following question(s):

“Would you please clarify what we can expect for the future? An article in the Journal News seemed to suggest revenue shortfalls and upcoming levies for Police and Fire. Please clarify this concern. Are we looking at increased taxes or renewals? What actions do you support to ensure the budget is balanced? “

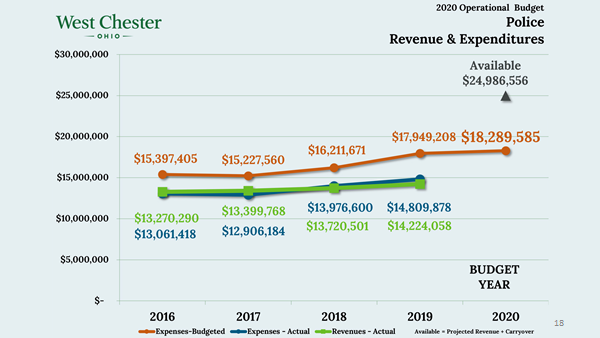

Below are three (3) graphs in the following order – Police, Fire, and Police & Fire Carryover. For reference purposes:

• ORANGE lines are BUDGETED Expenses,

• BLUE lines are ACTUAL Expenses, and

• GREEN lines are ACTUAL Revenues.

As you can see from the charts, BUDGETED Expenses (orange) are ALWAYS way high and we NEVER spend that much! We build in the conservative estimate to allow for budget flexibility and organizational responsiveness. It paid off when we had the radio purchases last year. When the reporter wrote the article, she referenced the BUDGETED Expenses vs. ACTUAL Revenue which in my opinion is not the proper comparison to make. She should compare, or at least mention, that the Township in it’s conservative budgeting process, always overestimates expenses. The proper comparison should be the historical Actual

As you can see from the charts, BUDGETED Expenses (orange) are ALWAYS way high and we NEVER spend that much! We build in the conservative estimate to allow for budget flexibility and organizational responsiveness. It paid off when we had the radio purchases last year. When the reporter wrote the article, she referenced the BUDGETED Expenses vs. ACTUAL Revenue which in my opinion is not the proper comparison to make. She should compare, or at least mention, that the Township in it’s conservative budgeting process, always overestimates expenses. The proper comparison should be the historical Actual

Expenses and Actual Revenues (blue and green) which are relatively close in amounts and you can see these amounts fluctuate from year to year. Some years expenses are higher than revenue, and other years revenue is higher than expenses.

Expenses and Actual Revenues (blue and green) which are relatively close in amounts and you can see these amounts fluctuate from year to year. Some years expenses are higher than revenue, and other years revenue is higher than expenses.

The CARRYOVER amount (shown in the last slide) is the amount of money left over in the Police and Fire & EMS funds at the end of each year to cover future expenses. As you can see the carryover balances are dwindling which is normal and to be expected from an outside millage levy like our Police and Fire levies. Collections are capped at values from 10 and 14 years ago, resp. while modest inflation, CPI, and wages increase over the same period, it is a mathematical impossibility to never renew. But that’s okay, it merely gives the public a chance to

participate in the decision-making process of how we want to shape our community. This is ONLY a prediction AND it is the WORST-CASE prediction because it’s based on the BUDGETED Expenses which are always high. To be fair, even an optimistic view will require some action and we will be exploring alternatives in the next few months.

participate in the decision-making process of how we want to shape our community. This is ONLY a prediction AND it is the WORST-CASE prediction because it’s based on the BUDGETED Expenses which are always high. To be fair, even an optimistic view will require some action and we will be exploring alternatives in the next few months.

So, to answer your question “Are we looking at increased taxes or renewals?” the answer is INCREASED TAXES, but not necessarily in the time frame the reporter wrote about. Depending on future expenses we could go another few years without it. Also, I don’t know how much of a bump the existing tax levies will get, but they will be layered on top of the existing levies, and there will probably only be one public SAFETY LEVY that will be used for both Police and Fire. Most of any new millage collection that may be approved is merely recapturing the inflation effect over those 10-14 years. By structuring it this way, we are preserving the HomeStead Rollback benefit currently funded by the State of Ohio, which changed the law with HB 59 in 2013. If we are not careful, the Rollback burden will come from the homeowners here in West Chester, whom we are taking measures to protect.

This is only my opinion, but the enormous drain on the levies is personnel costs, particularly the collective bargaining agreements with the unions. With these agreements our hands are pretty well tied and as one person said “West Chester is a victim of our own success” which means when we go to arbitration it’s a very tough negotiation for us. Our comparisons for PD, FF and EMT positions are in the upper half compared to our peers. But not at all near the top. This is ideal in order to attract good employees. Which is getting harder each day.

Let me give you some numbers that will elucidate the problem. Probably the best way to compare Personnel Costs is to calculate them as a percentage of Actual Revenue collected. Doing this, in 2005 Police Personnel Costs represented 77.3% of the Actual Revenue and Fire was 84.7%. This percent has fluctuated over the years and a few variables can make the revenue fluctuate, grants and EMS receipts would be 2 good examples (in general there are far fewer variables in the revenues than expenses), but the percentages are definitely trending upward as shown in the following table:

• 2005 Police – 77.3% Fire & EMS – 84.7%

• 2015 Police – 85.1% Fire & EMS – 88.9%

• 2016 Police – 85.7% Fire & EMS – 88.9%

• 2017 Police – 85.4% Fire & EMS – 85.7%

• 2018 Police – 87.6% Fire & EMS – 86.8%

• 2019 Police – 89.6% Fire & EMS – 91.9%

You can see that at some point in the future, Personnel Costs could approach 100% of the revenue collected. We all love our Police, Fire & EMS and we can’t live without them! They are a cornerstone of our community and significantly contribute to our designation as one of America’s best places to live, but we must be diligent to strike a balance between service(s) and cost.

My commitment to you is this – I’m looking into solutions that I’m not at liberty to talk about at this point, but suffice to say, prior to approving any township tax levy, I will require that the township “sharpen it’s pencil” and see where we might cut some costs and gain efficiencies in operations.

My commitment to you is this – I’m looking into solutions that I’m not at liberty to talk about at this point, but suffice to say, prior to approving any township tax levy, I will require that the township “sharpen it’s pencil” and see where we might cut some costs and gain efficiencies in operations.